GST Special Alert

GST Special Alert – What information do I have to keep?

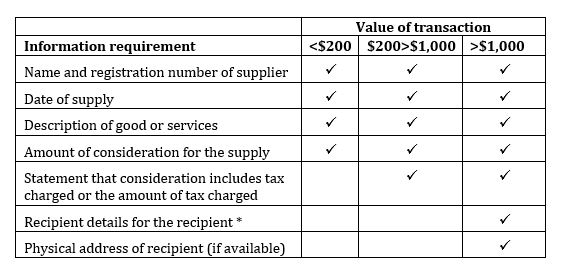

With the new rules on GST invoicing applying from 1 April 2023, ‘taxable supply information’ is effectively replacing tax invoices and must be retained and able to be provided.

The information required is dependent on the value of the transaction. We recommend watching this recorded webinar on GST record keeping changes, and checking out our summary below of information to you’ll need to keep after April 1st.

*Recipient details require the name of the recipient and one or more of the following:

- Address of a physical location

- Telephone number

- Email address

- Trading name other than the name of the recipient

- New Zealand business number (NZBN)

- Website address

There have also been some really important changes in this GST amendment bill related to property sales and mixed use assets. When we were listening to a specialist GST speaker this week our team heard him say “I believe these new rules are complex and quite different from the old GST rules. In some instances the new rules are more fair and in other ways the IR are increasingly wanting more information and reporting from taxpayers especially when dealing with property and high value asset transactions”.

If you are wondering about subdividing, selling property that had airbnb’s or other mixed uses eg horticulture etc – please talk to us while you are at the planning stages.

Contact us if you have questions.